An ongoing investigation into a significant financial fraud case has raised important questions about the vulnerabilities within international trade and banking systems. However, it is crucial to note that the individuals and companies implicated are yet to be found guilty, and the legal process is still unfolding. At this stage, they stand accused but not convicted, and their involvement in any wrongdoing has yet to be conclusively proven.

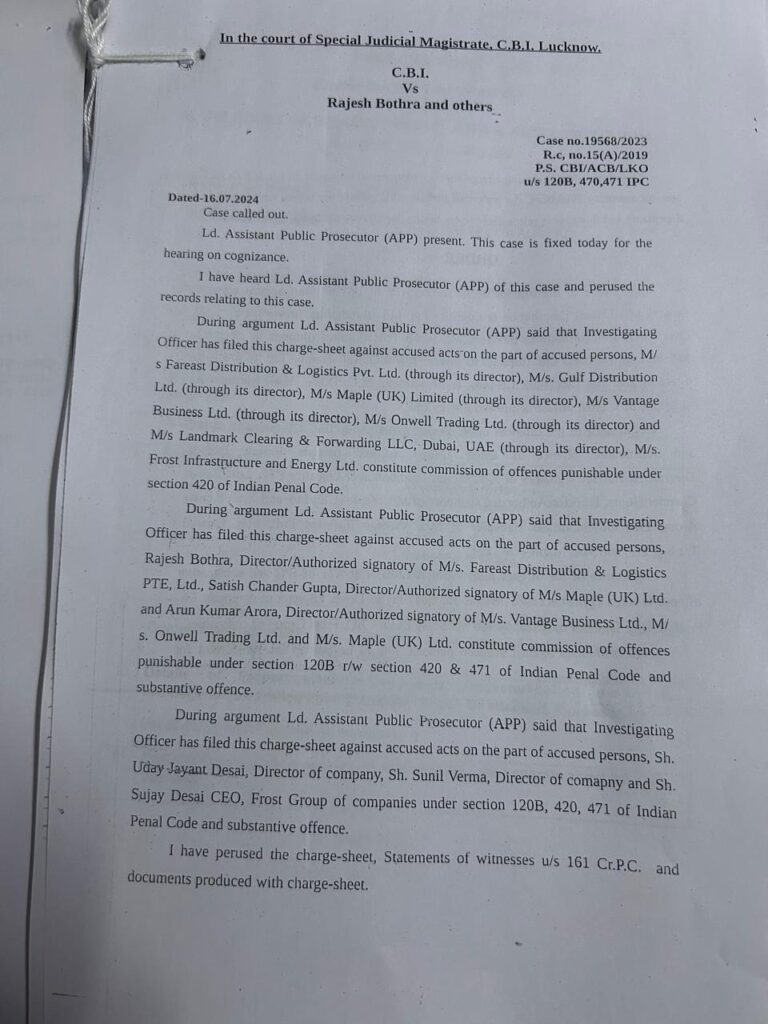

The case involves several companies, including Fareast Distribution & Logistics Pte. Ltd., Gulf Distribution Ltd., Maple (UK) Ltd., and Vantage Business Ltd., which have been linked to claims of document falsification and financial mismanagement. The directors and authorized signatories of these companies are facing allegations related to forged trade documents and attempts to deceive financial institutions. But it is important to emphasize that these are still allegations, and no party has yet been proven guilty in a court of law.

A Web of Allegations

At the core of the case is the allegation that forged documents—such as Bills of Lading and Letters of Credit—were used in transactions that may have misled financial institutions. These documents play a crucial role in international trade: a Bill of Lading confirms that goods have been shipped, and a Letter of Credit guarantees payment for those goods once delivered. However, the authenticity of these documents is still under investigation, and it is not yet clear whether they were intentionally falsified or whether there were other legitimate factors involved.

The accused individuals—Rajesh Bothra, Satish Chander Gupta, and Arun Kumar Arora—are currently facing charges of fraud, conspiracy, and document falsification. However, it is important to note that these charges are still being examined, and they maintain their innocence until proven otherwise. Allegations of fraudulent activity remain unproven, and the legal system will ultimately decide their fate.

Trade Finance Challenges and the Need for Reform

Regardless of the final outcome of this investigation, the case highlights certain vulnerabilities within the trade finance industry, where paper-based documents are still heavily relied upon. The fraudulent manipulation of documents, if proven, underscores the potential risks that exist when systems are not fully digitized or adequately monitored. However, it is also important to note that these vulnerabilities are systemic and are not the responsibility of any one company or individual.

Experts suggest that this case can be a valuable opportunity to reflect on the trade finance sector and the broader financial ecosystem. As global trade becomes increasingly complex, there is a growing need for better verification systems to ensure that trade transactions are genuine and secure. Banks and financial institutions must adapt to rapidly changing technology, ensuring that they utilize digital platforms to verify transactions in real-time. These platforms could offer a more secure and transparent way to prevent fraud, reducing the reliance on paper documents that can be manipulated.

A Call for Improved Oversight, Not Blame

The investigation may lead to stronger safeguards within the financial sector, but it is important to recognize that the case is still in its early stages. No conclusive evidence has yet emerged to prove the allegations of fraud. The banking and financial sectors, alongside regulatory bodies, must view this as an opportunity to improve practices, enhance transparency, and invest in more secure systems for verifying trade transactions. This investigation serves as a wake-up call to improve due diligence and create a safer financial environment for all involved, rather than a simple search for a villain.

The Legal Process and Future Implications

As the investigation progresses, it remains to be seen whether the accused individuals will face legal consequences. At this point, they are entitled to a fair trial, where the evidence will be examined thoroughly. If the charges are proven, the legal consequences may include fines, penalties, or other actions, but these will only be determined once all facts are reviewed in court.

This case could also spark broader conversations about the future of trade finance. If the allegations are proven true, it may prompt a reevaluation of current regulations and risk management strategies. It could lead to the adoption of more stringent checks and balances within the industry to prevent similar incidents from occurring. However, at this point, these remain potential changes that could emerge based on the results of the ongoing investigation.

Moving Forward: Optimism for Reform

In the end, the key takeaway from this case is not about pointing fingers, but about ensuring that lessons are learned. The allegations, still unproven, provide an opportunity for the financial and trade sectors to examine their existing processes and improve them for the future. The ongoing investigation will likely drive greater attention to issues of fraud prevention, digital verification, and international cooperation, helping to create a more secure and transparent system.

As the legal process continues, it is hoped that whatever the outcome, this investigation will lead to improvements that benefit all stakeholders—banks, businesses, regulators, and consumers alike. The financial industry must continue to evolve, leveraging technology and enhanced monitoring systems to protect against fraud, while ensuring that all parties receive fair treatment in the legal process.

Ultimately, this case serves as a reminder of the importance of transparency, due process, and the need for continuous reform in the financial sector. As the investigation unfolds, it is vital to approach the matter with an open mind and a commitment to justice, ensuring that lessons are learned and safeguards are strengthened for the future.